To increase money for development, PENANG intends to conduct a long-overdue modification of land tax rates by the next year.

This is the first change made since 1994.

The reform is required to address stagnant tax revenue, which has been static for more than thirty years despite a rapid increase in land values, according to Dr. Faizal Kamarudin, director of the Penang Land and Mines Office.

The statute allows for a ten-year review of land tax rates, although Penang hasn’t done so since the middle of the 1990s.

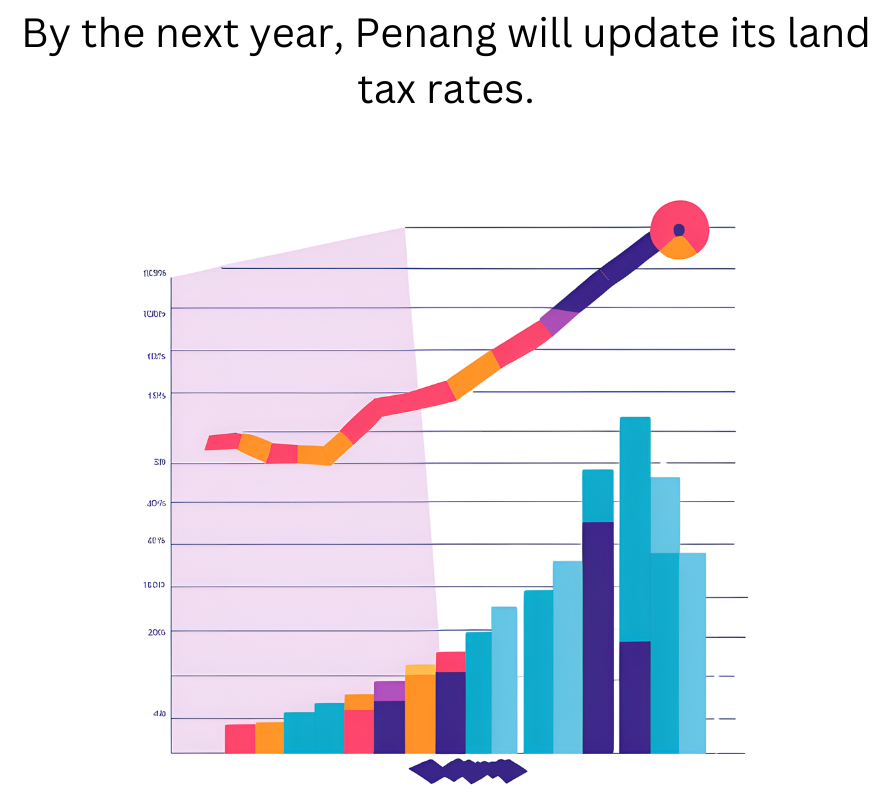

“In the meantime, land values have increased dramatically, with some areas experiencing increases of up to 1,000%,” Faizal told Bulletin Mutiara, the state newsletter.

Although landowners gain from this, the state’s revenue collection is unbalanced as a result of the lack of tax adjustments.

According to Faizal, the review will also make it easier to upgrade the e-Tanah system, enabling improved tax assessment based on ownership compliance, land use, and location.

First Grade land, which does not need a change-of-use approval for construction, is one major area of concern. These properties have been paying fewer taxes than necessary because of the antiquated tax rates, which has resulted in revenue leakage,” he stated.

Faizal emphasized, however, that strata property owners will not be impacted by the amendment, with the exception of those whose land category is changed from rural to urban.

Within ten years of the most recent review, which was conducted in 2019, tax rate adjustments are prohibited by the Strata Titles Act of 1985. Consequently, the parcel tax duties of around 300,000 strata unit owners in Penang will remain unchanged in 2026, according to Faizal.

All categories, including commercial and residential real estate, industrial land, and agricultural lands, would be affected by the land tax adjustment.

Currently, 194,362 of Penang’s 373,777 registered land titles are First Grade land, making up 51.99% of the state’s total property ownership.

Beginning on January 1, 2026, landowners will be able to check their updated tax amounts using the PgLAND online portal or by going to the closest Land Office after the amended rates are approved and gazetted.

“Updated tax bills will be issued as usual beginning in January 2026.”

According to Faizal, the state is researching the various tax adjustments to make sure that the ratepayers in this area won’t be overburdened.

However, a representative for one of the area’s leading developers has acknowledged that it would make sense for property prices to rise in tandem with the expenses of construction and development, particularly in Penang where the landbank is severely constrained.

The representative noted that there could be further pressure on living expenses in addition to potential spillover costs to the average taxes that ratepayers now have to pay.

However, the spokeswoman stated that the state government has the authority to determine the most effective way to reduce living expenses.

Leave a Reply